or “The non rich Slacker’s definitive report on being cashflow positive”

Let’s face it: being a millennial these days means you’re probably broke, let alone even close to rich. But fret not, my dear broke ass friend, because I’ve found a few ways to at least gtfo the crushing debt we are all faced with.

Now, I know most people like to play the blame game (and yes, I’m one of them, sometimes), but since when did that solve anything. Ever.

Nah, I’m too damn broke to continue doing that. So I got fed up and went to town on minimizing unnecessary purchases or expenses, got a bit savvy on how the banking systems work in my adoptive country, and took advantage of the most opportune choices I had at my disposal.

A lot of these financial gurus or pundits of our time always yap about ‘stop spending money on lattes’, or ‘invest in forex’, or other BS like that.

Tell you what, if I’m obligated to give up coffee like all these experts advise, especially in the morning, I’m gonna be putting my foot so far up their shady orifices so fast that loose change will get knocked out of their pockets!!

Now, let’s break the problem down into small, palatable chunks, and see what I did in order to not only stop bleeding nickels and dimes (or, in my case loonies and toonies, since I’m proudly almost an eighteenth Canadian by now, yay me), but actually put myself in the position of taking advantage of banks and credit corporations myself, instead of the other way around.

All legally, of course (before you ask).

1. Credit Cards

For most people, credit cards are very expensive debt. I don’t blame them.

But there’s a better way: how about instead of you owing the bank that pesky 19-22% interest on crap you impulse-bought-because-it-was-on-sale-and-you-have-literally-zero-use-for – the credit card companies can actually PAY YOU. *wink wink*

Yes, you read it right, it’s no mistake. Here’s how:

a) first, and I cannot stress this enough, do everything you can to pay off all credit card debt, as fast as possible; or declare bankrupcy and start over, but for seven years you’re in a bit of a pinch in this case. Most people refuse to do it because of the stigma associated with having ever declared bankrupcy.

I have news for you, the current president elect of the arguably most powerful country on this planet has had his companies use bankrupcy just what it was designed for – a tool. Now if that guy can do it, why can’t you?

If you’re ashamed of it, then you’re stuck in debt. Best of luck to you.

b) second, look at the current offer of credit cards that are available to you on the market. Yes, that means googling your butt off and comparing card benefits for ten to thirty minutes. Here’s a query: “best cash back credit card in <your country>”.

Here’s another: “best rewards credit card in <your country>”.

Let me venture a wild stab in the dark now: your current credit card doesn’t do anything for you compared to the ones you just googled, right?

If my guess is right, go ahead and first apply for the best cash-back or rewards credit card you can find and is available to you based on your credit score, and as soon as you have the new card in hand, go ahead and close down your former credit card.

If my guess is wrong, then go ahead and give yourself a nice pat on the back, and maybe treat yourself to something nice, guilt-free. You deserve it, you little finance aficionado, you… I like you.

c) For now, third, always pay the damn balance, in full, before the grace period is up (usually 21 days from the statement date).

If you live in western countries, you’ve probably heard by now of something called ‘credit score’. If you haven’t, please google that, and don’t confuse it with credit report. Usually you can coerce the credit rating agencies to provide you with the latter, for free, once or twice a year. But that’s for another time.

Recap: pay the credit cards if you can. It’s the most expensive and hurtful debt that will haunt you for years. When you’re in the black, you can actually make most of your purchases using your new, cash-back or rewards credit card, and actually be paid by the bank for using the credit card, over the year. Different banks, different credit card companies, they all have different benefits, but they can all be legally gamed for fun and profit.

I don’t have some super fancy credit card, but the one I do have offers a pile of benefits:

– car rental preferred rates (15-25% off of the price the average joe pays)

– car rental insurance (so I don’t let rental companies rip me off with shady liability insurance premiums)

– roadside assistance (for any car I drive, rental or mine)

– extended warranty (pretty much any electronics I buy will have double the usual manufacturer/retailer-backed 1 year warranty, if I use this credit card to buy them)

– travel protection:

a)Common Carrier Travel Accident Insurance

Up to $500,000 coverage for you and your family while travelling on a common carrier.

b)Delayed and Lost Baggage Insurance

Up to $1,000 reimbursement if checked baggage is lost or delayed by more than six hours.

c)Trip Interruption Insurance

Coverage should illness or injury delay or cancel your trip.

d)Purchase protection

e)Purchase Security and Extended Warranty

Items purchased with your Card are covered in case of theft or damage.

and, of course:

– 1% Cash Rebate on any purchase

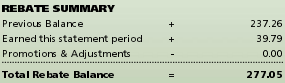

Here’s how it looks when the bank actually pays you, even after you’ve benefitted from the rest of the stuff above, which is not that trivial to quantify:

#GetSome

2. Banks

Banks out here have you pay a monthly fee to keep your money with them. That’s fine, to some degree, as long as they’re not greedy bastards and charge you lots of your already hard earned cash for next to no value provided back to you.

But they are. Greedy bastards, that is.

But you can play that game too, no?

Here’s how:

a) first off, google is your friend: go compare all the banks in your area, in terms of checking account offerings, and benefits. It might take an hour or so, but you want to be looking for things like these from your checking account:

– unlimited free transactions; you see, most banks in North America charge you per transaction. A transaction might be you swiping your debit card with a merchant. Or issuing a check that someone cashes, or asking a teller for information, or depositing your paycheck. So.. anything that you do, basically.

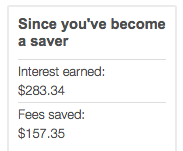

– decent interest rate on the money you keep with them. In the checking account, yes. We’ll get to savings in a minute. The first bank I’ve dealt with upon arriving here has NO interest rate for checking accounts, as most other banks. But a couple do give you some interest back at the end of each month. Not a lot, but maybe a coffee’s worth. It all adds up. It’s the greedy goblin way

– decently high interest rate on your savings account; that’s right, my former bank, 0.05%. My current bank, 2.8% for the first 6 months, then 2% after that; I say #gimme and thank you

– free transfers

![]()

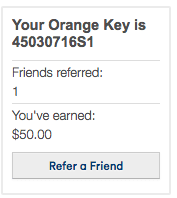

– referral rewards; if you bring them customers, they should pay you, no? Damn straight!

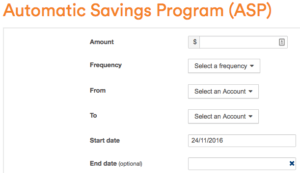

– automation around savings. Mine is called ASP – automatic savings plan, and essentially I scheduled the checking account to spill a percentage of the money into my savings account, every time I get any money deposited into my checking account. So every paycheck, some of it automagically goes into savings, before I even see it. Friggin’ #WIN

– fast, comprehensive and secure smartphone app. Comprehensive as in – you should be able to do everything on the app that you can on their site, nothing less. Secure as in, logging in with fingerprint biometrics preferred, but at the very least it should force you to have 2 factor authentication in effect. So that if your phone is stolen, your money is safe.

The previous bank I used had a simple 4 digit pin password, no rate-limiting (so whoever stole my phone would’ve had, at most 10000 combinations to try until completely owning me), no 2 factor auth, no biometrics, and you couldn’t perform even 50% of the normal daily banking activities your average joe would perform (you still had to log in to their site, on a computer, because it’s not responsive for phones and tablets).

At least the old bank gave me an actual Android tablet for signing up with them. Still net positive, overall, heh…

3. Budgets

Everyone says keep a budget. I would get so annoyed when I’d hear that, because I had no friggin’ idea what it even meant.

In time, after becoming passionate about finance, getting fed up with being stupid and a target for rip-offs, I’ve come to understand that it really pays off going through a bi-weekly exercise of:

– analyzing my spending per category, per week, per month

– making adjustments in my spending allocation (and still failing at honoring the allotments sometimes, but whatever, the math still checks out if it’s small enough amounts)

– profits and losses deep-dive, see where I’m spending most and thus

– curbing stupid spending (like impulse spending, desperate spending, and so on…)

– allocating certain amounts for unexpected expenses

– timing, or spacing out optional expenses (holidays, that new iphone, whatever… based on expected income dates, etc.)

If you’re a bit of a finance geek, I recommend Mint.com (which got bought by Intuit, the good people you trust with your tax records since the dark ages or so); They automate the math-running for you, make recommendations, show you trends, send you bill notifications, aggregate accounts, and all sorts of other goodies you can also do yourself with 4th grade math, patience and ten times as slow if you were so inclined to do.

But if you’re ghetto like me, I started out by exporting my checking and savings accounts’ in a common format like .csv files (most banks have this functionality), and then importing it all in a Google Spreadsheet. Then grinding it out for hours to get some idea of where my money is going.

It was a slow, painful learning process. Which, as you can probably tell, paid for itself hundred-fold, hehe…

It’s never a tools problem with most people, I find. It’s a I’m-too-damn-lazy-to-give-a-damn-about-my-future problem most times.

4. Automation

Now, I saved the best for last, because by now you should be well ahead of the pack, with regards to being in control of your money.

Here’s the gist, physicist:

– if you got yourself a decent bank, grabbed hold of your debt and squeezed it down to zero, then CONGRATULATIONS! You’re now cash-flow positive. But don’t go buying everyone a round of drinks just yet.

– you now have to think about investing in yourself, keeping your (now) growing money – by automating your saving, your investing, and even your spending.

– your bank should have the tools to allow to you:

a) automatically save a chunk of every sum of money entering your checking account; at a very minimum, I suggest 10%, more if you can afford it, until you sock away a good 1-3 years worth of revenue-less living at your current spending rate. This is critical if you want to not just survive, but thrive.

b) automatically route a chunk of your income to spending guilt-free bucket (1-3%). Because life is NOT only about saving money, silly!

c) automatically invest a chunk of your income in long term, lowest fee index funds that mimic either the market (in which case you expect a meager but safe seven percent return) or the world’s most prolific investors that invest with their own money (Buffet, Munger, Gates, Icahn, etc., in which case you should see a tidy double digit return in percentage points). Recommended 5-10%. More if you can stomach it.

d) automatically max out your tax free/deferred retirement savings (TFSA or 401k/RothIRA etc.); also, make sure it’s not a risky fund that you have your retirement stash into, stick with lowest cost, safest investments possible. Note that most opinions differ on this one, some say stick with gold and silver, some say real estate, some say food production, etc. Land and metals with intrinsic value are always a good investment. Purely because nobody can print more of it, and because they’re valuable on their own, and no Wall Street monkey can convince you otherwise, no matter how much they might try.

e) downsize your living situation if your rent/mortgage is taking more than 40% of your income; Do you really need that huge house, or could you be just as comfortable in something more cozy and inexpensive? Most people won’t touch this one, but I believe it to be one of the biggest expenses of people’s lives, and most folks know nothing about it.

With the information you now have, you might either be geeking over compounding interest with a bunch of people gathered around you at your next cocktail party with their jaws dropped, or you might be that awkward nerd in the corner that all the debt-ridden ‘peasants’ will ask for a job in 10 years from now. *wink wink*

Either way, you’re awesome! And relatively rich, I hope 🙂